Welcome to the FINANCIAL INSTRUMENTS Platform

The FINANCIAL INSTRUMENTS platform, co-financed by the European Union, is specifically designed to assist businesses, citizens, and public bodies in identifying suitable financing opportunities and receiving support. Within this platform, you’ll discover information about available financing tools. Additionally, you can access valuable insights for developing your business, including guidance on expanding your activities abroad.

Funding opportunities exhibit variability and often come with specific application timeframes. Renewal dates, along with new extension options, remain flexible and can be adjusted at any point. As the sources of this information are constantly being updated, we deemed it necessary to create, in addition to the main list of available financial tools, a list that includes links that lead directly to the websites (sources) managing and publishing the financial tools. This way, we can always ensure the most recent and up-to-date information for our users about all available financing tools and application dates.

Each information source and financing choice is accompanied by a dedicated link leading to their official publication websites. Click on the provided link to explore further details and submit your application.

SOURCES

NATIONAL STRATEGIC REFERENCE FRAMEWORK 2021-2027 – NSRF 2021-2027

The new “NSRF 2021-2027” reflects and prioritizes the strengthening of the productive potential of the economy, infrastructure, human skills and the strengthening of social protection.

The projects/actions to be funded by the new NSRF take into account the specific conditions and requirements of Greece in the coming years and respond to the structural shortcomings of the Greek economy. At the same time, major projects launched under the NSRF 2014-2020 are being continued and finalized.

As an overall policy, it sets out the priorities and actions to be implemented, which aim to make a successful transition to a:

- “smarter” Greece – 20% of the resources

- “greener” Greece – 27% of resources

- “interconnected” Greece – 8% of resources.

- “More social” Greece – 30% of resources

- Greece closer to its citizens – 6% of resources

- Just Transition of Delignation areas – 7% of resources

For more information please click here.

National Recovery and Resilience Plan Greece 2.0

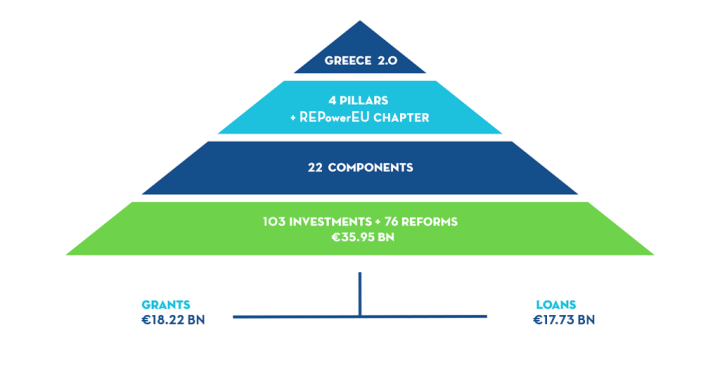

The National Recovery and Resilience Plan ‘Greece 2.0’ was adopted on July 13, 2021, by the Economic and Financial Affairs Council of the European Union (Ecofin), amounting €30.5 billion, while on December 8, 2023, its revision was approved, concerning mainly new investments and reforms under REPowerEU as well as expanding the existing loan program.

The revised Plan amounts to €35.95 billion. It includes 103 investments and 76 reforms, structured around four pillars, including the new REPowerEU chapter: Green Transition, Digital Transformation, Employment-Skills-Social Cohesion, Private Investments and Transformation of the Economy.

Its resources are channeled into grants and loans and is expected to mobilize over €60 billion of total investment in the country by the end of 2026, when all projects should have been implemented.

For more information please click here.

Hellenic Development Bank – HDB

The Hellenic Development Bank (HDB) is a valuable element in the integration of Micro, Small and Medium size enterprises (MSMEs) financing cycle, through the collateralization of the fraction of business risk not accepted by the banking system, thus amplifying the scope of viable entrepreneurial initiatives undertaken by MSMEs.

Through a very focused business agenda, continuously adjusted to counterbalance the negative effect of the difficult macro- economic environment on MSMEs sustainability. HDB aspires to become a reference institution in the provision of supplementary funding for the greek MSME market, and as such a growth model for the local economy.

For more information please click here.

Public Employment Service (DYPA)

The Public Employment Service is the official public authority and central structure managing a wide range of policies and actions for the benefit of the citizens.

DYPA is a central pillar of the welfare state and an operational arm for the fight against unemployment. The main actions of DYPA focus on supporting and strengthening the workforce through the promotion of employment, unemployment insurance, social protection of motherhood and family, vocational education and training, but also on other social policy actions aimed at improving the livelihoods of the workforce.

For more information please click here.

FINANCIAL TOOLS – GREECE

PRODUC – E GREEN

The object of this action is to support investment projects for the production of products in the field of green industry, with an emphasis on the production sector of electrification, renewable energy sources as well as products and goods intended for energy saving.

The action aims at technological, productive, administrative and organizational upgrading, as well as innovative and extroverted development and growth, with the ultimate goal of strengthening the competitive position of productive enterprises in the domestic and international market.

For more information click here .

Green Taxis

The objective of the “GREEN TAXI” call is the promotion of electric mobility and the penetration of electric vehicles into the fleet of TAXI vehicles circulating within the Greek territory. The green environmental policy reflected in the National Energy and Climate Plan (NECP) aims, among other things, at the transition to zero- and low-pollution mobility which will be achieved through the gradual reduction of Greenhouse Gas (GHG) emissions due in transportation.

For more information please click here.

CREATION OF BABY CARE SPACES WITHIN BUSINESSES

The objective of the project is to expand the range of childcare facilities as an integrated service within workplace, providing immediate support to working parents and society still reeling from the economic fallout of the pandemic. In-house childcare facilities actively increase the participation of working parents and especially mothers, strengthen gender equality in the workplace and in the family, and contribute to the well-being of working parents and their children.

For more information please click here

Submission of applications: The application of interested parties to participate in the Action is submitted exclusively, electronically, through a special platform. To submit an application click here.

CHARGE EVERYWHERE

The objective of this call is the installation of more than 8000 publicly accessible recharging points (300000 kW as the cumulative installed power of these points) throughout the Greek territory, including urban, peri-urban areas as well as other points of interest along highways, within ports, airports, etc.

Therefore, this action aims to provide financial support for investments that will contribute to economic and social resilience, in safe and sustainable transport and in clean, efficient production and use of energy, through the strengthening of publicly accessible recharging infrastructures throughout the Territory, which are powered by energy produced by Renewable Energy Sources (RES) with the aim of creating a core network (trunk) of public charging in the country, with the maximum geographical and population coverage, but also ensuring a healthy competition.

For more information please click here.

Photovoltaics on the Roof

The “Photovoltaics on the Roof” Program, grants households to install Photovoltaic (PV) systems with storage and farmers for the installation of PV systems with or without a storage system for self-consumption with the application of energy offset.

The Program aims at the installation of photovoltaic stations for self-consumption of electricity in combination with electric accumulator systems (batteries), which contribute to energy savings, in the pursuit of the building stock approaching near-zero energy consumption specifications by 2050, as well as achieving lower costs of living.

For more information please click here.

“INNOVATION AND GREEN TRANSITION IN AGRICULTURAL PRODUCT PROCESSING” 2nd CALL

The objective of the Sub-Project is:

- To increase the degree of cooperation in the primary sector through collective schemes and/or the adoption of contract farming.

- The improvement of the position of the farmer in the value chain.

- To strengthen the competitiveness of products in the markets with research, modern technology and digital tools.

- The integration of innovation processes and the use of new technologies, but also environmentally friendly processes that limit the phenomenon of climate change.

- The sustainable development and more efficient management of natural resources.

Each investment plan needs to fulfill at least one of these objectives.

Submit applications: www.gov.gr –, using Taxisnet codes.

“INDUSTRIAL DOCTORATES” CALL

The project aims to satisfy the need for creating links between private companies and University Institutions through industrial research, solving problems in the productive sector through focused industrial research as well as the corresponding transfer of know-how from Greek universities to companies.

The main strategic priorities to which the project contributes are the following:

- Strengthening the connection between universities, as research organizations, and the market, facilitating the transfer of knowledge to the real economy and stimulating innovation.

- Knowledge transfer to companies and applied scientific research to produce innovative products or services.

- Contribute to business innovation and growth, with an emphasis on cutting edge technologies.

- Strengthening the cooperation between private companies and university institutions.

- Training and development of innovative researchers into industrial researchers.

- Providing incentives for private investment.

- Strengthening links between university institutions and businesses.

- Connecting young researchers with the private business sector.

- Promotion of Research and Development programs in cutting edge technologies

Promoting applied industrial research and strengthening the employment of young researchers to stop the “brain drain”.

The application concerns the conduct of industrial or applied research, with a view to export research results to produce innovative products or services, as well as conducting an industrially focused research project.

RESEARCH – INNOVATE 2021-2027

The main objective of the single action “Research – Innovate 2021-2027” is to connect research and innovation with entrepreneurship and to strengthen the competitiveness, productivity and extroversion of businesses towards international markets, with the aim of transitioning to quality innovative entrepreneurship and the increase of domestic added value.

The Action is aimed at businesses, with an emphasis on small and medium enterprises (SMEs), and research organizations. The proposals that will be strengthened concern research and innovation projects. The application area of the Action is the entire territory of Greece.

The Action is primarily aimed at satisfying the needs of businesses and other entities active in the research and innovation ecosystem, covering the maximum possible range of potential Beneficiaries.

The Funding Applications that will be strengthened in the context of the Action can be submitted either by individual small and medium enterprises, or by groups of enterprises, or by partnerships of enterprises with research organizations.

For more information please click here

Energy Save In Business

The action “Energy Save In Business ” – Improving the Energy Efficiency of Very Small, Small and Medium Trade, Services and Tourism Enterprises is part of the policies and measures of the National Energy and Climate Plan (ESEK), which defines in detail the plan action to achieve specific energy and climate targets by 2030. Key elements for the ESEK are improving energy efficiency by implementing the strategy for building renovation in the residential and tertiary sectors and improving the energy efficiency and competitiveness of the industrial sector. The application area of the Action is the entire territory of Greece.

The proposed program is part of an effort to implement the green transition and is related to the following climate and environmental objectives set out in EU Regulation 2020/852:

- limiting climate change

- adaptation to climate change

- transition to a circular economy

For more information click here.

Green Transformation of SMEs

The Action entitled “GREEN TRANSFORMATION OF SMEs” aims at the operational upgrading of the country’s small and medium enterprises.

This Action “Green Transformation of SMEs” encourages investment projects aimed at the utilization and development of modern technologies, the upgrading of the products produced and/or services provided and their activities in general, rewarding actions that utilize modern technologies, infrastructures and best practices in matters of energy upgrading, circular economy and adoption of clean energy sources. The Action is co-financed by the European Union, in particular by the European Regional Development Fund (ERDF) and by the Greek State. The application area of the Action is the entire territory of Greece.

For more information click here.

Advanced Digital Transformation of SMEs

The main objective of the Action is the upgrading of SMEs through the utilization of advanced systems and technologies with which can improve their position in international markets, strengthen operational flexibility, improve the production process and also upgrade their competitiveness. The Action encourages, as a matter of priority, the implementation of targeted digital transformation investment projects that contribute significantly to an extroverted, innovative, competitive and sustainable operation of companies producing products and providing services of higher added value. The application area of the Action is the entire territory of Greece.

The Action concerns businesses that aim to expand their digital and technological maturity with integrated investments in new ICT that will upgrade their competitiveness.

Submission of Applications: 23/02/2023 at 12:00 to 22.03.2024 at 15:00 – EXPIRED

For more information click here .

LEADING SME DIGITAL TRANSFORMATION

The main objective of Action is the upgrading of SMEs with cutting-edge technologies or advanced digital systems of the 4th industrial revolution and additionally the coverage of individual needs in information and communication technologies (ICT) that expand their productivity and competitiveness. The Action encourages, as a matter of priority, the implementation of targeted digital transformation investment projects that contribute to an extroverted, innovative, competitive and sustainable critical production of products and services of higher added value. The application area of the Action is the entire territory of Greece.

The Action concerns companies that have already integrated ICT in many of their operations and now seek to implement integrated investments in cutting-edge technologies or 4th industrial revolution solutions.

Submission of Applications: 23/02/2023 at 12:00 to 22.03.2024 at 15:00 – EXPIRED

For more information click here .

GREEN SME PRODUCTIVE INVESTMENT

This Action “Green SME Productive Investment” encourages small investment projects that aim to utilize and develop modern technologies, to upgrade the products produced and/or services provided and their activities in general, rewarding actions that make use of modern technologies, infrastructures and best practices in matters of energy upgrading, circular economy and adoption of clean sources. The application area of the Action is the entire territory of Greece.

The Action is co-financed by the European Union, in particular by the European Regional Development Fund (ERDF) and by the Greek State.

Start of Submission of Applications: Wednesday 22/03/2023 at 12:00

For more information click here.

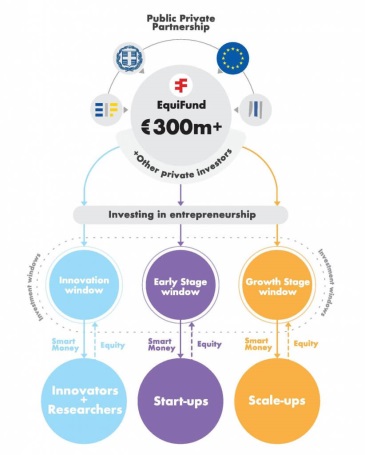

EquiFund

EquiFund is an initiative created by the Hellenic Republic in cooperation with the European Investment Fund (EIF). It is advised independently by the EIF.

EquiFund is co-financed by the EU and national funds, as well as funding from the EIF. The European Investment Bank has joined the existing cornerstone investors through the European Fund for Strategic Investments, the core of the so-called ‘Juncker Plan.’ Strategic Partners such as the Onassis Foundation and the National Bank of Greece have also committed to several of the EquiFund supported funds.

EquiFund will pave the way for unleashing the social and economic wealth-creation of young talented human capital in Greece and its diaspora.

For more information please click here.

“KNOW YOUR CUSTOMER (KYC)” INITIATIVE OF THE HELLENIC DEVELOPMENT BANK (HDB)

The Hellenic Development Bank’s “Know your customer” initiative makes it easier for small and medium-sized businesses to have access to bank loans, as although they could get a loan, they are unable to get a loan from a bank due to their size. The “Know your customer” initiative includes four financial programs totaling 2.5 billion Euros. The aim is to link investments, grants and low-interest loans with the obligation of businesses to adapt to the double challenge of digital transformation and climate change, the green transition.

The “Know Your Customer” platform of the Hellenic Development Bank (HDB) has been operating since January of this year at the online address https://kyc.hdb.gr/. With this platform, a clear picture is created for the whole of entrepreneurship (tax – insurance awareness) and the State knows in detail which businesses have problems with which State bodies.

Specifically, the “Know your customer” platform is interconnected with AADE (Independent Authority rod Public Revenue), EFKA (National Social Security Entity) and Teiresias (system which specializes in the collection and supply of credit profile data on corporate entities and private individuals and the operation of a risk consolidation system regarding consumer credit) in order to certify the tax, insurance awareness and solvency of the businesses concerned. On the same platform, entrepreneurs submit their business plans in a standardized form and declare the banks they want to approach.

In this way, the competitiveness between banks is strengthened so that there are more chances that the application will be approved by a bank in the context of expanding the portfolio and there are chances that a company will get a better offer in terms of speed and amount of financing.

The companies that can proceed with bank loans reach 100,000 to date. A key advantage for businesses is that the part of the loan that is co-financed by the bank is interest-free, resulting in a 40% lower final interest rate on the loan.

For more information please click here.

Business grant program for the recruitment of 1,000 unemployed people aged 30-66 in the Region of Eastern Macedonia & Thrace – D.Y.P.A.

The purpose of the program is to create 1,000 new full-time jobs for the recruitment of unemployed people aged 30-66 in the Region of Eastern Macedonia and Thrace.

Beneficiaries of the program are private businesses operating in the Region of Eastern Macedonia and Thrace, while beneficiaries are unemployed people, registered in the DYPA unemployment register, aged 30-66

Businesses submit an application online via gov.gr here .

For more information click here .

Development Law Financial Instrument Guarantee Fund (DeLFI GF)

The “Development Law Financial Instrument Guarantee Fund (DeLFI GF)” is a new financial instrument created by the Hellenic Development Bank S.A. with the purpose of supporting the financing of newly established and existing sustainable businesses that meet specific criteria and aim to implement investment projects within the framework of the new Development Law N.4887/2022.

DeLFI GF operates as a bridge between Credit Institutions and businesses, creating an enabling environment where businesses can access financing despite potential uncertainties and risks associated with new investment efforts under the Development Law. Essentially, in this way, DeLFI GF contributes to strengthening of Greek entrepreneurship and activity, and to the overall economic development of the country.

t applies to existing and newly established Very Small, Small, and Medium-sized Enterprises (SMEs) (as defined in Annex I of Regulation (EU) No 651/2014) that have been classified under a support scheme through the new Development Law 4887/2022 and have not commenced operations before submitting their application on the KYC platform.

For more information click here.

Green Co-financed Loans

The Green Co-Financing Loans Fund was established to provide favorable terms regarding investment loans to small and medium-sized enterprises (SMEs), offering 40% of the capital interest rate-free and a two-year partial interest subsidy upon the Financial Intermediary’s interest rate for the remaining 60% of the capital, for the implementation of Green Transition investment projects. Investment projects regarding Green Mobility, Energy Efficiency/Energy Upgrades, and Energy Production through Renewable Sources are supported.

The Fund aims to support SMEs to meet their investment purposes in implementing Green Transition projects that facilitate reducing emissions, protect the environment and reduce energy consumption costs.

The Fund applies to small and medium-sized enterprises that own a legal establishment and operate within Greece and were established up to the year of submitting the financing application to the Financial Intermediary.

For more information please click here.

Digitalization Co-Financing Loans

The Digitalization Co-Financing Loans Fund was established to provide favorable terms regarding investment loans to small and medium-sized enterprises (SMEs), offering 40% of the capital interest rate-free and a two-year partial interest subsidy upon the Financial Intermediary’s interest rate for the remaining 60% of the capital, in order to undertake investment projects in digitalization and digital upgrade of their operations.

The Fund aims to support SMEs to meet their investment purposes, which are submitted via a business plan, in order to digitize and digital upgrade their operations, so as to increase productivity, achieve business growth and create new jobs.

For more information click here .

Micro-Agri Loans Fund for Agricultural Entrepreneurship

INVESTMENT LOANS WITH THE OPTION OF RECEIVING WORKING CAPITAL FOR SMEs OPERATING IN THE AGRICULTURAL AND AGRICULTURAL PROCESSING SECTOR

The Micro-Agri Loans Fund for Agricultural Entrepreneurship was established to provide co-financing loans via Financial Intermediaries, in order to obtain Small and Medium Enterprises operating in the agricultural and agricultural processing sector access to financing.

The goal of the Fund is accomplished by offering loans on favorable terms, with 50% of the capital of each loan being interest rate-free, as it is financed by the Micro-Agri Loans Fund for Agricultural Entrepreneurship, which is managed by the Hellenic Development Bank (HDB). Additionally, the Fund offers to final beneficiaries a full interest subsidy on the interest rate applied by the Financial Intermediary for the remaining 50% of the capital of each loan for the first two years, plus a grant up to €300 per Tax Identification Number (TIN), optional and upon request, for technical and advisory help (mentoring).

For more information click here .

Innovation Guarantee Fund

The Hellenic Development Bank (HDB) launched early June 2022 the first Innovation Guarantee Fund and for the first time, Greek SMEs, Startups, and Innovative companies benefit from an innovative financing program aiming in strengthening the competitiveness and extroversion of Greek entrepreneurship by supporting the implementation of Research and Development for innovative ideas, products, and practices.

Through this program, available through Greek Financial Institutions, HDB offers to the market a hybrid Loan that combines the provision of a unique combination of loan guarantee and grant of up to 20% of the loan capital, based on the achievement of innovation and ESG criteria (Environmental, Social and Corporate Governance criteria), strengthening innovative entrepreneurship in practice

For more information click here .

Financing program for small and medium-sized enterprises and enterprises of medium capitalization for the professional empowerment of women

This is an action of the European Central Bank which aims to strengthen the access of eligible companies to bank financing with favorable terms . Eligible businesses are those that support female entrepreneurship and strengthen the presence of women in leadership positions.

Cooperating banks:

For more information click here .

Entrepreneurship Fund II (TEPIX II) – ‘Business Financing’ Action.

The ‘Business Financing’ Action of the Entrepreneurship Fund II (TEPIX II) is aimed at promoting entrepreneurship, facilitating access to financing mechanisms for micro, small and medium‑sized enterprises, and strengthening the country’s investment activity.

Under the action, loans are to be granted on favourable terms, given that 40% of the capital of each loan is interest‑free, as it is financed by the

Entrepreneurship Fund II of the Hellenic Fund for Entrepreneurship & Development S.A.

The resources for the Action amount to EUR 366 million, provided by the Entrepreneurship Fund II, financed for this purpose by the Operational Programme ‘Competitiveness, Entrepreneurship and Innovation’ (EPAnEK). In addition to the capital to be paid by the Entrepreneurship Fund II, the cooperating banks contribute 60% to each loan at a co-investment ratio of 1.5 (partner bank) to 1 (TEPIX II).

Eligible enterprises are micro, small and medium‑sized enterprises in the eligible economic sectors that are in the process of being established, newly established or already existing, and that are developing sustainable business activity in Greece.

The expression of interest of the Businesses is carried out through the Information System, at the electronic address www.ependyseis.gr , stating the cooperation Bank from which wishes to be financed.

Loans of the European Investment Bank to SMEs and mid -cap companies

Loans with a lower interest rate through cooperating financial intermediaries . Mid-Cap companies can apply directly to European Investment Bank .

For more information click here .

Sources – BULGARIA

Bulgaria’s recovery and resilience plan

Bulgaria’s recovery and resilience plan has responded to the urgent need to foster a strong recovery, while making Bulgaria’s economy and society more resilient and future ready. In response to the energy market disruption caused by Russia’s invasion of Ukraine, the Commission launched the REPowerEU Plan. The Recovery and Resilience Facility is at the heart of its implementation and its funding. Under REPowerEU, EU countries are updating their recovery and resilience plans with new measures to save energy and diversify the EU’s energy supplies.

HOW DOES THE BULGARIAN PLAN HELP CITIZENS?

It helps improve people’s quality of life through improved social security, more sustainable public transport, lower energy bills due to energy-efficient homes, improved air quality on foot of decarbonisation and uptake of renewable energy sources, accessible social and healthcare services, and quality education and training.

HOW DOES THE BULGARIAN PLAN HELP BUSINESSES?

It tackles key challenges for businesses’ competitiveness, including skills shortages, the digitalisation and greening of business practices and improving the business environment.

HOW DOES THE BULGARIAN PLAN STRENGTHEN OUR UNION?

It helps build stronger and more secure EU financial system and capabilities to fight corruption and money laundering. It ensures more effective biodiversity protection.

For more information please click here.

Investment Promotion Act.

This Act settles the terms and the order of encouraging investments on the territory of the Republic of Bulgaria, the activity of the state bodies in the sphere of encouraging investments, as well as their protection.

The main purposes of this Act shall be:

raising the competitive abilities of the Bulgarian economy through increase of the investments for science research, innovations and technological development in high added value production and services by observing the principles of steady development; improvement of the investment climate and overcoming the regional divergence in the socioeconomic development; creating new and highly productive job positions.

Investment promotion under this Act shall be carried out mainly by:

- administrative servicing in reduced terms and individual administrative servicing;

- sale or for profit constitution of limited real rights in estates that are private state or private municipal property without auction or contest according to market or lower prices;

- sale or for profit constitution of limited real rights in terrains with developed inbound technical infrastructure of public state ownership without auction or contest according to market or lower prices;

- financial assistance for development of technical infrastructure components; financial assistance for training and acquisition of professional qualification;

- financial aid for partial refund of the mandatory insurance payments made to the state social insurance, additional mandatory pension insurance and mandatory health insurance for the account of the investor as an employer to the benefit of newly hired employees for the implementation of the investment project;

- possibilities for other forms of state aid, institutional support, public-private partnership or constitution of mixed companies – for priority investment projects;

- various types of transactions between the investor and a trade company established for construction and development of industrial zones;

- tax relief under the Corporate Income Taxation Act.

This Act also establishes that if an international agreement, party to which is the Republic of Bulgaria, stipulates more favourable conditions for carrying out economic activity by foreigners the more favourable conditions shall apply according to the international agreement.

For more information please click here.

Fund of Funds

Fund Manager of Financial Instruments in Bulgaria EAD (FMFIB) operates as a Fund of Funds (FoF); it allocates targeted public funds from European Union programmes and national co-financing, using special financing schemes (financial instruments).

The FMFIB’s mission is to

- ensure efficient use of EU financial resources;

- create a more favourable business environment, promote employment and economic development in Bulgaria;

- provide enhanced access to financial resources for the private and public sectors in Bulgaria by applying innovative and flexible forms of financing;

- support business competitiveness and sustainability;

- provide opportunities for development of innovative business ideas;

- assist projects with a growth potential;

- improve the quality of life in towns and regions.

The FMFIB has the goals to

- leverage public resources by mobilising additional private capital;

- achieve economies of scale;

- ensure sustainability in fund management by applying corporate practices of proven efficiency and a prudential approach, taking into consideration inherent risks;

- build capacity to manage financial instruments at the national level in order to overcome Bulgaria’s dependence on external expertise in that area.

For more information please click here

Start-up Funding for Young Entrepreneurs

The main objective of the strategy is to support the Bulgarian small and medium-sized enterprises (SME) in their efforts to be competitive, digital, sustainable and export-oriented enterprises, which manufacture goods and services of high added value.

Measures aimed to young people are foreseen in two impact areas of the strategy, and namely: Entrepreneurship and Digitalisation and Skills.

The specific objectives in these two impact areas in terms of young people are as follows:

- Increase of the share of youth entrepreneurship activity;

- Maintaining information database of employers that employ and train school students, young people and persons under 29 years of age in dual training form (on the job training).

The specific actions to be undertaken for the achievement of these objectives are:

- Support for young people who want to start up a business as self-employed persons and in SME in key types of entrepreneurship through trainings, consultancy and mentorship services.

- Distinguishing SME employers active in the field of dual training of school students, young people and persons under 29 years of age;

- establishment and awarding of annual prizes for SME employers with achievements in dual training.

For more information please click here

Sources – EUROPEAN UNION

Access to EU Finance

EU Funding is available for all types of companies of any size and sector.

A wide range of financing is available: loans, microfinance and venture capital. Every year the EU supports more than 200 000 businesses. The EU also supports businesses with grants and contracts. Funding is usually provided through selected financial intermediaries.

Find the right one for you at www.access2finance.eu

How to get EU funding?

Financing is usually provided through a local bank in your country. Find your local institution at www.access2finance.eu. The decision to provide EU financing will be made by the local financial institutions such as banks, venture capitalists or angel investors.

CulturEU Funding Guide

With this interactive guide, the European Commission wants to ease access to the funding opportunities available for the cultural and creative sectors across all the funding sources of the European Union available in 2021-2027.

The aim is to help players in these sectors identify the most suitable sources of EU support for their projects.

How it works

Answer a series of questions based on the sector you are working in, the type of organisation, and the support you are looking for. The results will enable you to narrow down the relevant funding sources and calls available that best suit you.

The results will be accompanied by the available budgets, application process of the different funding sources and a link to the specific programme or calls.

For more information please click here.

FINANCIAL INSTRUMENTS – EUROPEAN UNION

COSME Loan Guarantee Facility – COSME Mechanism Warranty Loans

Loans to SMEs with reduced collateral , due to the provision of guarantees by the European Investment Fund.

The program is aimed at companies from all main sectors of business activity (according to the eligibility criteria).

For more information please click here .

InnovFin SMEs Guarantee Facility – Loan Guarantee Mechanism for innovative SMEs

Loans to innovative SMEs and small to medium capitalization ( Small MidCaps ) with a reduced interest rate, reduced collateral due to guarantees from the European Investment Fund.

For more information please click here .

The Digital Europe Programme “

The Digital Europe Programme (DIGITAL) is a new EU funding programme focused on bringing digital technology to businesses, citizens and public administrations.

The European Commission has begun to look at a greener Europe through the lens of the European Green Deal. At the same time, it is opening up discussions about the move to a more digital world: the digital transition.

The Digital Europe Programme will provide strategic funding to answer these challenges, supporting projects in five key capacity areas: in supercomputing, artificial intelligence, cybersecurity, advanced digital skills, and ensuring a wide use of digital technologies across the economy and society, including through Digital Innovation Hubs. With a planned overall budget of €7.5 billion (in current prices), it aims to accelerate the economic recovery and shape the digital transformation of Europe’s society and economy, bringing benefits to everyone, but in particular to small and medium-sized enterprises.

For more information please click here.

Finance and support from the EU

Finance and funding

What EU funds are available, how to apply for business loans, access to finance in EU countries: Find loans and venture capital

Direct and indirect EU funding, funding conditions, who is eligible for EU funding, how to apply for funding: EU funding programmes

Support for small businesses

Contact Enterprise Europe Network for advice, support and opportunities for growing your business internationally: Enterprise Europe Network

About microfinance – loans below €25,000, how to apply for microcredit in your country: EU microfinance support

How the EU’s European Innovation Council and SMEs Executive Agency (EISMEA) supports small business, programmes run by EISMEA: Support for small businesses in Europe

How the European Commission helps businesses expand outside the EU, studies into the benefits of expanding your business internationally, available support for businesses that want to expand: Expanding your business outside the EU

A range of businesses from across the EU share their stories: Small business success stories

EU policy on improving access to finance for small businesses, EU policy on loans and guarantees, venture capital, crowdfunding, private investment and growth stock markets, EU rules and initiatives in financing small businesses, financial instruments available for small businesses, practical advice for businesses looking for finance: Access to finance for small businesses

EU regional policy, funding programmes, accessing regional funds: Small business competitiveness in structural investment funds